“You cannot get a new economy without a new society.”

– Alvin Toffler

Barter Trade:

After several thousands of years of hunter-gatherer living, humanity settled down on the banks of rivers, tending to agriculture and domestication of animals, around ten thousand years ago. They resorted to ‘barter’ in their economic transactions as of necessity. Early coins, primarily Roman and Greek, date back to the eighth century BCE. But their share of usage was negligible compared to the barter trade.

From the early days of the current age onwards, barter trade between different countries continued, but in towns and cities the buying and selling of commodities with money significantly increased. The use of metal coins began to replace sea shells as media of exchange in an improved system of exchange. Much later still, paper notes were introduced in China.

Thus the age of coins-bills-currency of money commenced. Now, all the sovereign countries have their currencies. However, barter trade continued between nations until the middle of the Twentieth century. After the devastating second World War, in 1944, Dollar was recognised as a global exchange currency at the Bretton Woods Conference.

Physical Money:

Money is born in the creation of economic goods and services and extinguishes in their consumption. Money as a medium of exchange “has the advantage of eliminating inefficiencies of barter; a unit of account, which facilitates valuation and calculation; and a store of value, which allows the conduct of economic transactions over long periods as well as geographical distances. To perform these functions, money has to be available, affordable, durable, fungible, portable and reliable. Because they fulfil most of these criteria, metals such as gold, silver and bronze were for millennia regarded as the ideal monetary raw material.” (Niall Fergusson: The Ascent of Money).

Digital Money:

Historically, money has developed diverse identities. The exponential growth of economic transactions happened in the last two centuries. The advent of Industrial and post-industrial revolutions has transformed the limited pastoral connectivity to global connectivity, unleashing the stagnant population of millennia in just two centuries, from 900 million to 7.8 billion. We have moved money from coins, bills and bullion to plastic and digital, appearing on the screen of a desktop or a mobile device, enabling millions of transactions and movement of billions of monetary wealth across the globe in a matter of seconds. Digital currencies, plastic and online are fast replacing physical currency, now accelerating due to Covid-19 social distancing norms. Several countries are moving to a cashless society by 2022. Leading the pack is Finland, Sweden, China, South Korea, UK, Australia. The cost of production, distribution and maintenance of traditional currency for any country is 0.5 per cent of the GDP, while the cashless system costs a fraction of it, and the rollout is fast and easy. Predictably, we witness mushrooming of various digital monetary platforms [Razorpay, Google pay, Amazon pay, Paytm] that enable cashless transactions. The world is becoming a cashless society.

Tradable Share Flips Commodity:

Marx refers to Aristotle and barter trade “as he (Aristotle) goes on to show, the original form of trade was barter, but with the extension of the latter there arose the necessity of money. On the discovery of money, a barter swap of necessity developed into trading in commodities, and this again, in opposition to its original tendency, grew into chrematistic [wealth as measured in money], into the Art of Making Money.”

How? Until the end of the sixteenth century, companies were guilds or partnerships whose members pooled their resources to do things that none could accomplish in isolation. But then, on 24 September 1599, a company was founded whose ownership is cut up into tiny pieces to be bought and sold freely and anonymously, like pieces of silver, called tradable-Shares. One could own a piece of the new company without being involved in it. The first global joint-stock company was thus born – undoubtedly England’s most revolutionary invention. Its name? – British East India Company.

Separating ‘ownership’ from the rest of the East India Company activities unleashed a fluid, irresistible force of a monetary institution – the Stock Market. Unchecked, the East India Company grew more powerful than the British State, answerable only to its shareholders. At home, its bureaucracy corrupted and largely controlled the British government. Abroad, the 200,000 solid private armies oversaw the destruction of the well-functioning economies of the Indian sub-continent and several Pacific islands and ensured the systematic exploitation of their people.

Casino Capitalism:

The Banks and their powerful clients create Money for each other out of thin air. First, the bankers grant their wealthy customers huge overdraft facilities with which to buy shares. Thus, the Client uses entirely fictitious Money to acquire bits of different companies. They do not seek dividends from the company profits. Instead, they sell their shares at a higher price to others, who also use fictitious money from overdraft provided by another bank. As long as this racket continues, the trade-in shares roar and their price soar. If the companies do happen to profit, share prices soar even higher, leaving bankers with fat commissions. And when the bubble bursts, the overdrafts turn NPA in the bank’ books, their losses are transferred to the taxpayers or public savings as a loss. The political establishment plays a role in the conversion of private personal loss into a general public loss.

Marx sought to explain that Money was commoditised labour, appropriated by the capitalist class, and the favoured instrument is tradable-share. To restore the investor as a stakeholder of any enterprise and anchor investment to the real economy, tradable-shares, the source of speculative stock markets, must be replaced by non-tradable shares. When the tradable-shares are moved out of the equation, stock markets and the economy would be free from Casino capitalism.

The US Dollar as World Currency:

Sovereign nations have their currency which serves as legal tender in the territory. Each country maintains two major accounts to conduct the economy. The first one is for Internal Income and Expenditure or national Budget – using the sovereign currency. Second is the Current or External Account for Payments and Receipts from various countries conducted in global currency (US Dollar) for imports and exports of goods and services.

The destruction of the dominating economies of Britain and Europe in two world wars, and the emergence of the US unscathed with fifty per cent of the global GDP, paved the way for the recognition of the Dollar as global currency, linked to bullion at $35 per one Ounce of gold, at the 1944 Bretton Woods Conference. America also held at that time two-thirds of the world’s gold reserves. The US rejected an alternate proposal advocated by eminent economist Keynes for a neutral world currency managed by a global bank and an ‘international clearing union. The current crisis of the worldwide economy historically can be traced to this event in history. In 1971, the US under Nixon Presidency unilaterally cancelled the direct convertibility of the US dollar to gold. This move effectively ended the Bretton Woods Agreement, unleashing anarchistic, monetary market fundamentalism globally.

The US Gaming CAD:

A Current Account Deficit (CAD) occurs when a country imports more goods from nations and services than exporting (if the reverse were true, it would be in a surplus). The US resolved its Current Account Deficit by printing Dollars. At the same time, the US and its Allies dominated the International Monetary Fund (IMF), European Central Bank (ECB) and World Bank (WB). Their stiff conditions and interest payable on loans extended to the weaker nations effectively drained the resources and wealth of the underdeveloped countries and vulnerable sections of the society.

The Banks, IMF/ World Bank/ ECB are the Bill collectors to the affluent countries under few billionaire capitalists and MNCs influence. This system of financial exploitation has its origins in Bretton Woods Agreement, conferring on the US the privilege of printing Dollars (global tender) instead of borrowing to pay for its imports like any other country. China, as a lender, is aggressively imposing its currency as a part of its economic colonialism. The Keynesian proposal of neutral world currency managed by an International Clearing Union deserves serious attention.

The Concentration of wealth:

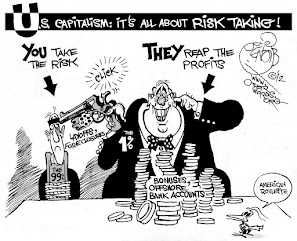

In the words of Marx, “Accumulation of wealth at one pole is, therefore, at the same time accumulation of misery, the agony of toil, slavery, ignorance, brutality, mental degradation, at the opposite pole…”. Crony and casino capitalism of the wealthy One per cent revels in stock and commodity markets, while 99 per cent are paying for it in blood and sweat. Every facet of life – culture, politics, and economy turned subservient to the one per cent masters of the monetised universe of financial capitalism, who control human and natural resources for maximisation of profits for the few. The tradable shares and the global stock markets are instrumental in this relentless transfer of wealth from the working classes and poorer countries worldwide.

“Ideas are the currency of the new economy.”

– Richard Florida

P R Sarkar advocates and cautions, “keep the money rolling, the more often it changes hands, the more people benefit …be vigilant about two important points. First, the intrinsic greed of the banks must not be allowed to jeopardise the life of the common people. Banking must be under cooperatives, not in private hand. Secondly, the banks must not allow unwise administrators or governments to print monetary notes indiscriminately without reserving the proportionate amount of bullion in their treasuries.”

The nations are under pressure to print money due to post-covid economic stress, and whatever fiscal discipline was there in the world has disappeared. Expect inflation and pain in most of the economies of the world. Post-pandemic unemployment, slashed wages, and higher food inflation is pushing millions of families into nutritional poverty and malnutrition among children.

Cashless Community:

Cashless trading systems have sprung up with different names to stimulate economic activity in communities around the world. The largest one today is the Barter Club of Argentina, founded in 1995. As the economy plunged into recession, bartering became increasingly popular and more varied, and a paper trade unit created called the ‘Credito’. Today more than ten million people participate in more than 8,000 locations around the country. Such instruments of cashless transactions should be convertible to standard and stable national currencies.

Next Revolution – The GovCoins:

The creation of digital government currencies or ‘govcoins’ will let people deposit funds directly with a central bank, bypassing the traditional banking system. The govcoins could cut the operating expenses of the global financial industry. It will let government digital currencies make instant payments to citizens and cut interest rates below zero. For ordinary users, the appeal of a free, safe, instant, universal means of payment is obvious.

According to The Economist, over 50 monetary authorities, representing the bulk of global GDP, are exploring digital currencies, including China, the EU, Britain, and America.

However, the centralisation of the monetary system in the national central banks enables abuse to penalise dissident entities and citizens instantly. Prout model of Samaj Cooperative Central bank and its govcoins resolves these concerns.

Socio-economic Groupification – Samaj:

Samaj is a Unit of socio-economic groupification – based on similar economic problems, uniform economic potentiality, ethnic similarity, shared sentimental legacy, similar geographical features. Forty-four such socio-economic units are identified for India, for example. Similarly, based on these criteria, other countries should be divided into Samajas to promote their economic development and eradicate poverty.

“You cannot get a new economy without a new society.”

– Alvin Toffler

As a state of being, Samaj is a self-sufficient and self-reliant community living in familiar territory. As a process, Samaj is a movement to oppose economic, psychic, cultural and psycho-economic exploitation.

Within this system, human beings will have the right to reside and claim citizenship of any Samaj in the world, without any discrimination. The sole qualification required is that an individual’s economic interests are invariably merged with the economic interests of the chosen Samaj.

Prout’s Monetary System and Banking:

P R Sarkar emphasises that “to ensure the socio-economic development of each unit, check the drainage of money from one region to another. If the drainage of Money is not checked, – the per capita income in a socio-economic unit cannot increase.” To ensure this, each Samaj will have a Cooperative Central bank as a fiscal and monetary regulator of samaj-specific currency and samaj-wide banking operations. The digital technology of a cashless economy will be superior to traditional currency in security and trackability. At the same time, it is cost-effective in production distribution, more accessible and will have faster roll-out. It acts as a firewall and prevents drainage of all kinds of the limited physical wealth of a Samaj. Primarily Samaj economy is based on the policy of ‘local production for local consumption. Samaj export of processed surpluses will be allowed only after the satisfaction of local Samaj needs. Further, Prout advocates the need for a convertible national currency with a stable standard value to avoid inflation.

Prout advocates the need for a convertible national or trans-samaj world currency with a stable standard value to avoid inflation. The European Union’s experience of Common currency, along with home currencies of the individual countries, since its introduction in 2002, deserves study for suitable adoption in a Prout Society.

” To fulfil the mutual needs between regions, Prout encourages the barter system in preference to the export system. The export system ultimately becomes commercial and competitive and leads to exploitation.” [P R Sarkar]

Post-covid, the corporatist market fundamentalism will be discarded. The majority of the corporations cannot survive the decimation of capitalism, already under threat since the 2008 Recession. The New Economy of the future will be cashless economic democracy that will end inequality and injustice. The clarion call, ‘Localise the Economy – Globalise Humanity’ – will resonate in all the world’s nations.

By G. Surender Reddy